If you’re receiving disability benefits through SSDI, you’re probably keeping track of when your monthly payments will arrive. The Social Security Administration (SSA) has a schedule for distributing SSDI payments, and for July 2025, here’s when you can expect your deposit:

SSDI Payment Dates for July 2025

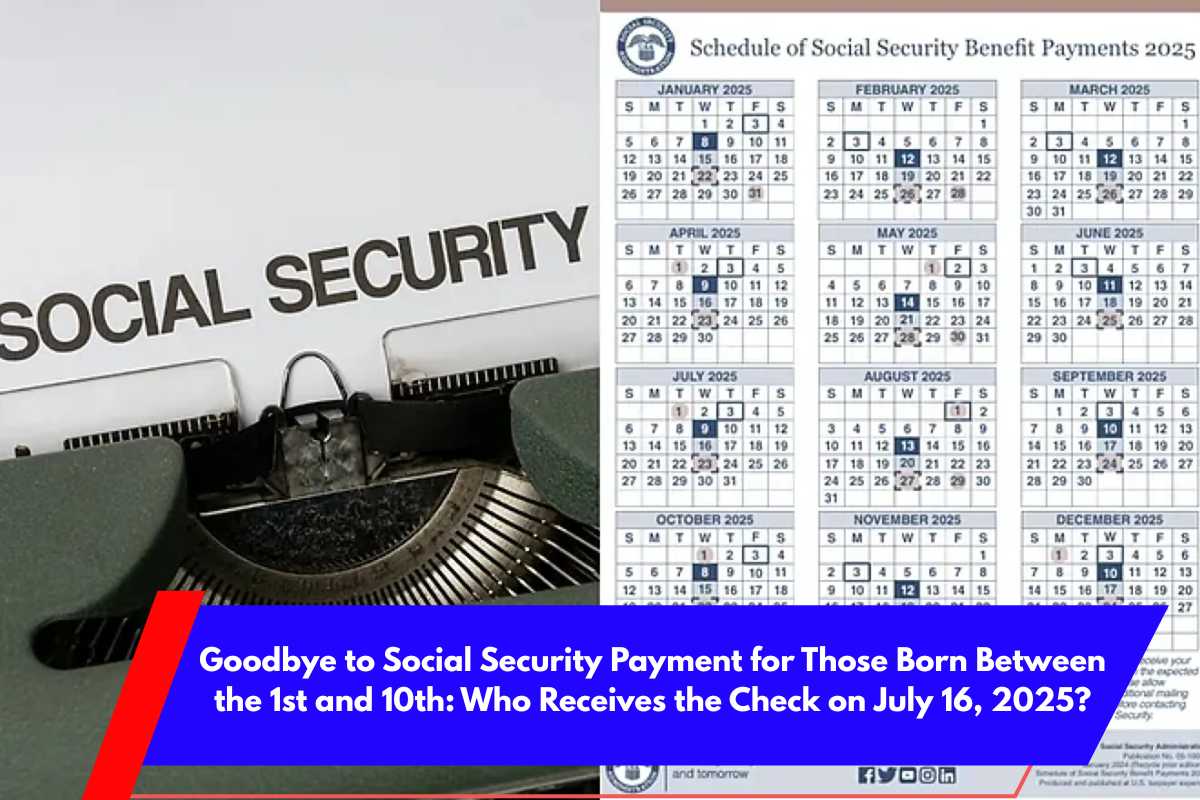

The SSA sends out SSDI payments based on the beneficiary’s birthday, with different groups receiving payments on different Wednesdays each month. Here’s how the schedule breaks down for July:

Born between the 1st and 10th: Your payment was already issued on Wednesday, July 9th.

Born between the 11th and 20th: Your payment will arrive on Wednesday, July 16th.

Born between the 21st and 31st: Your payment will be issued on Wednesday, July 23rd.

There’s also a special group of people who have already received their payments earlier. Those who began receiving SSDI before May 1997 or those who also receive Supplemental Security Income (SSI) benefits have already been paid on July 3rd.

How Much Is the Average SSDI Payment in 2025?

For 2025, the typical SSDI payment is around $1,580 per month, according to legal experts and official sources. This amount is based on the beneficiary’s disability and prior contributions to the Social Security system.

To put that in perspective, the average monthly payment for retirees is $2,002, which is notably higher, but this reflects the different programs and rules for SSDI vs. retirement benefits. The maximum SSDI benefit for 2025 is $4,018, while the maximum retirement benefit is $5,108.

The End of Paper Checks: What You Need to Know

If you’re still receiving paper checks for your SSDI payments, time is running out. A new presidential mandate, effective March 2025, requires that all federal payments be made electronically, with the deadline for transitioning to direct deposit or other electronic methods set for September 30, 2025.

This change affects all federal payments, including SSDI, SSI, tax refunds, and vendor payments. Nearly 485,000 beneficiaries still rely on paper checks, many of whom are elderly or have limited access to banking services. If you don’t transition to electronic payments by the deadline, your payments could be delayed or interrupted.

Why the Change?

There are several reasons for this major change:

Security: Paper checks are much more vulnerable to being lost or stolen—an estimated 16 times more likely than direct deposits.

Cost: The federal government spends nearly $750 million every year on processing paper checks.

Efficiency: Electronic payments are faster and more reliable, ensuring you get your payments on time without the risk of delays or lost checks.

How to Make the Switch

If you haven’t switched to direct deposit yet, now is the time to act. The easiest way to receive your payments securely and on time is by setting up direct deposit into a bank account. If you don’t have a bank account, you can use a Direct Express card, which is a prepaid debit card designed to receive federal payments.

To sign up:

Online: Visit SSA.gov to enroll in direct deposit.

By Phone: Call the SSA’s toll-free number.

In-Person: Visit your local Social Security office.

Prepaid Card: For those without bank accounts, visit GoDirect.gov, the official site managed by the Department of the Treasury, for more details.

Exceptions to the Paper Check Elimination

While the transition to electronic payments is mandatory, there are limited exceptions. If you live in a remote area with no access to banking or have a documented emergency, you may be eligible for an exemption. However, this is not automatic—you must apply directly to the SSA or Department of the Treasury and submit the required documentation to support your case.

If you think you qualify for an exemption, don’t wait until the last minute to apply. The process can take time, and waiting too long could leave you without your payments after September 30, 2025.