If you’re one of the millions awaiting your Social Security payment for July 2025, here’s what you need to know about when to expect your deposit. The Social Security Administration (SSA) operates on a monthly payment schedule, with payments tied to the beneficiary’s birth date.

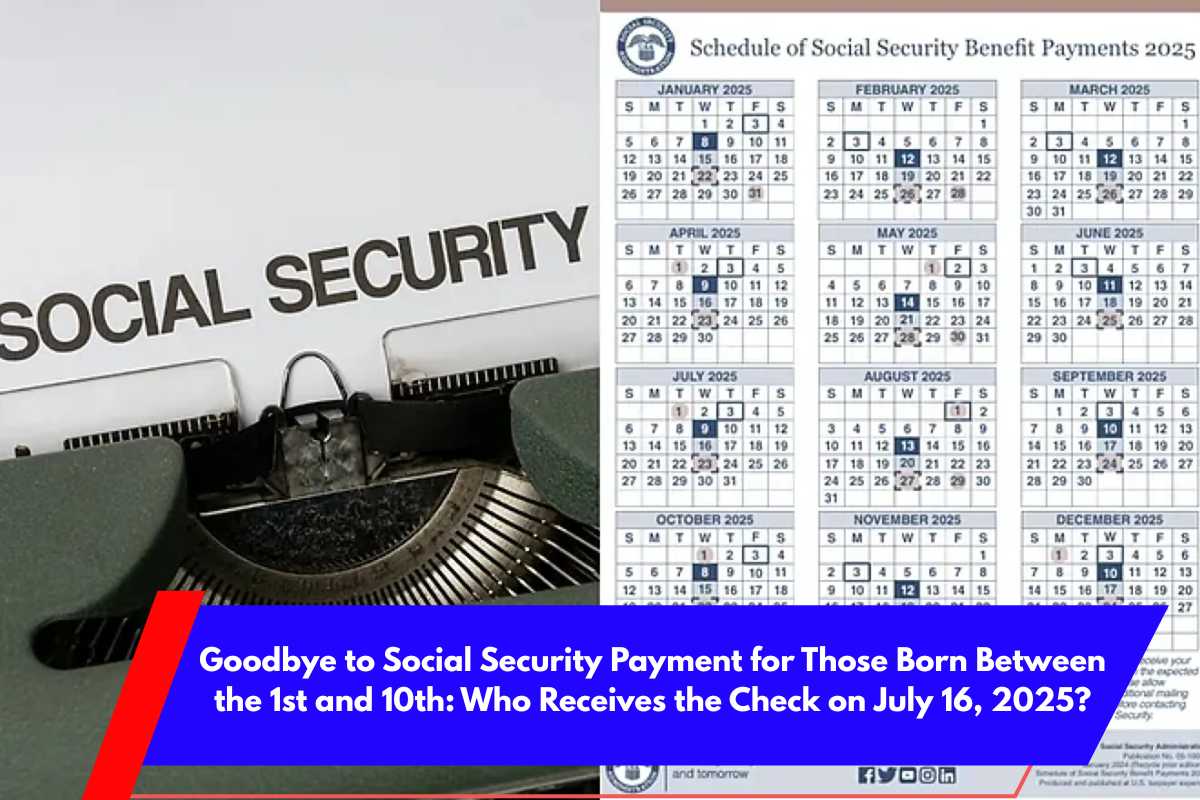

July 9, 2025 (Second Wednesday): For those born between the 1st and 10th of the month.

July 16, 2025 (Third Wednesday): For those born between the 11th and 20th.

July 23, 2025 (Fourth Wednesday): For those born between the 21st and 31st.

However, there are a few exceptions:

If you started collecting benefits before May 1997, your payment was issued earlier on July 3rd.

If you receive only SSI, your payment was issued on July 1st.

Breakdown of Social Security Payments and Beneficiaries

As of 2025, 73.9 million Americans are receiving Social Security or SSI benefits. This includes:

52.6 million retired workers

7.2 million SSDI recipients

5.8 million survivors of deceased beneficiaries

4.9 million individuals receiving both Social Security and SSI

In May 2025, the typical retired worker’s check reached $2,002.39, surpassing the $2,000 mark. However, when you factor in spouses and children, the average monthly check drops to $1,950.27.

Maximum Monthly Benefit: How Much Can You Get?

The amount you receive in Social Security benefits varies based on your claiming age and work history. Here’s how the benefit amounts break down:

Age 70 (Maximum Benefit): Up to $5,108 per month

Full Retirement Age (66-67): Up to $4,018 per month

Claiming Early at Age 62: You can receive up to $2,831 per month

To qualify for the maximum benefit of $5,108, you need to meet these two conditions:

35 years of work in jobs covered by Social Security

Earnings close to or at the maximum taxable income limit each year.

What is the Maximum Taxable Income for Social Security?

For 2025, the maximum taxable income for Social Security is $176,100. This means the first $176,100 of your income is subject to the 6.2% employee tax (and an equal contribution from your employer), resulting in a total contribution of $21,836.40.

For self-employed individuals, the 12.4% total tax applies, meaning they are also subject to the $21,836.40 maximum if their income meets or exceeds the $176,100 threshold.

Why Social Security Payments Increased in 2025

Two main factors boosted 2025 Social Security checks:

Cost-of-Living Adjustment (COLA): A 2.5% increase nudged the average benefit from $1,927 to $1,976, helping beneficiaries keep up with rising grocery prices.

Social Security Fairness Act: This Act eliminated pension penalties for public servants like teachers and firefighters, leading to retroactive payments averaging $6,710, which many recipients received by early July.

How Much Do You Really Need to Retire?

While many experts say you need $1 million to retire comfortably, that number is not a universal rule. Your location, lifestyle, and inflation play a significant role in determining how much money you’ll need in retirement.

The 4% rule is a common guideline, suggesting you can safely withdraw $40,000 per year from a $1,000,000 nest egg. However, market fluctuations and unexpected expenses can derail this rule.

Adjusting for Reality: Retirement Planning Tips

Track Current Spending: Start by determining how much you currently spend annually, then factor in 3% inflation for each future year.

Account for Non-Investment Income: Include any Social Security or pension income to supplement your savings. If you already receive Social Security, your savings goals may not need to be as high.

Plan for Location and Healthcare: Your retirement plan should also take into account where you live (for example, rural Italy vs New York City) and the cost of healthcare, especially if you retire early.