Imagine Martha, a former software engineer from Austin, sitting down to open her January SSDI benefits statement. Her eyes widen as she sees the amount: $4,018 — a $98 increase from last year. She’s among the select Americans who are hitting a new peak in Social Security Disability Insurance (SSDI) payments, but getting here wasn’t simple or quick.

That $4,018 figure isn’t arbitrary. It’s the result of Martha’s high-earning career, her decision to wait until 67 to claim, and the cost-of-living adjustments (COLA) implemented each year. While many headlines celebrate “record high” payments, few explain why Martha’s check dwarfs her neighbor Richard’s average $1,537 monthly payment.

Why Martha’s Check is Bigger Than Richard’s

The key difference lies in lifetime earnings. Unlike welfare programs, SSDI is designed to pay back what a person has put into the system. Martha’s six-figure salary years and consistent payroll tax contributions built her safety net.

For someone like Richard, a construction foreman who had to retire at 62 due to a back injury, the story is different. Despite the same cost of living, Richard’s monthly check is significantly smaller because he filed earlier, which led to what’s called “actuarial reductions” — penalties for filing earlier than the program’s typical age of 67.

Martha’s decision to push through chronic pain until age 67 allowed her benefits to grow, particularly when the 2.5% COLA increase was applied. This strategic decision boosted her final payout, but the reality isn’t so simple for everyone.

Three Key Rules for Maximizing SSDI

To qualify for the record-setting $4,018 check, beneficiaries need to meet three major hurdles:

Earnings History: Beneficiaries must have near-constant wages brushing against Social Security’s taxable maximum — $168,600 this year. The SSA reviews the top 35 years of earnings, inflation-adjusts them, and calculates averages. Few individuals qualify for this level of benefit.

Timing: Disability claims can increase in value with age. For instance, filing at 70 instead of 66 can give a 32% premium on monthly benefits. But this is a difficult trade-off for those who are too sick to wait.

No Double-Dipping: If you’re also receiving Supplemental Security Income (SSI), your SSDI payment will be reduced. Therefore, it’s important to understand how receiving both can impact your final payout.

COLA Increases and Benefit Erosion

While Martha’s check saw a $98 bump, many beneficiaries, like Linda from Miami, only received a modest $30 increase, despite facing the same inflation at the gas pump and pharmacy.

This disparity is known as “benefit erosion”, and it’s been a growing issue for SSDI recipients. Since 2000, SSDI payments have lost 30% of their purchasing power, especially as healthcare costs for seniors have soared.

Linda, with her $1,200 check, isn’t celebrating the 2.5% COLA as much as others. “My rent jumped 10% last year,” she says. “This COLA feels like using a teacup to bail out a sinking boat.”

What’s Coming in the Next COLA Increase?

The big question now is: What’s next for SSDI payments in 2026? Mark your calendars for October 10, 2025, when the Social Security Administration will announce next year’s COLA adjustment.

Early estimates from the Senior Citizens League predict a 2.8-3.4% increase. This could mean an increase of $112 for Martha, pushing her check to $4,130 in January 2026.

However, there’s a catch. Economic factors, such as rising oil prices or changes in housing costs, can shift the COLA estimates dramatically. “We’re hostage to economic winds until September’s final data,” says Social Security Commissioner Martin O’Malley. If inflation spikes due to higher gas prices or geopolitical events, SSDI checks could see a larger-than-expected increase. But, if housing costs cool, the COLA bump could shrink.

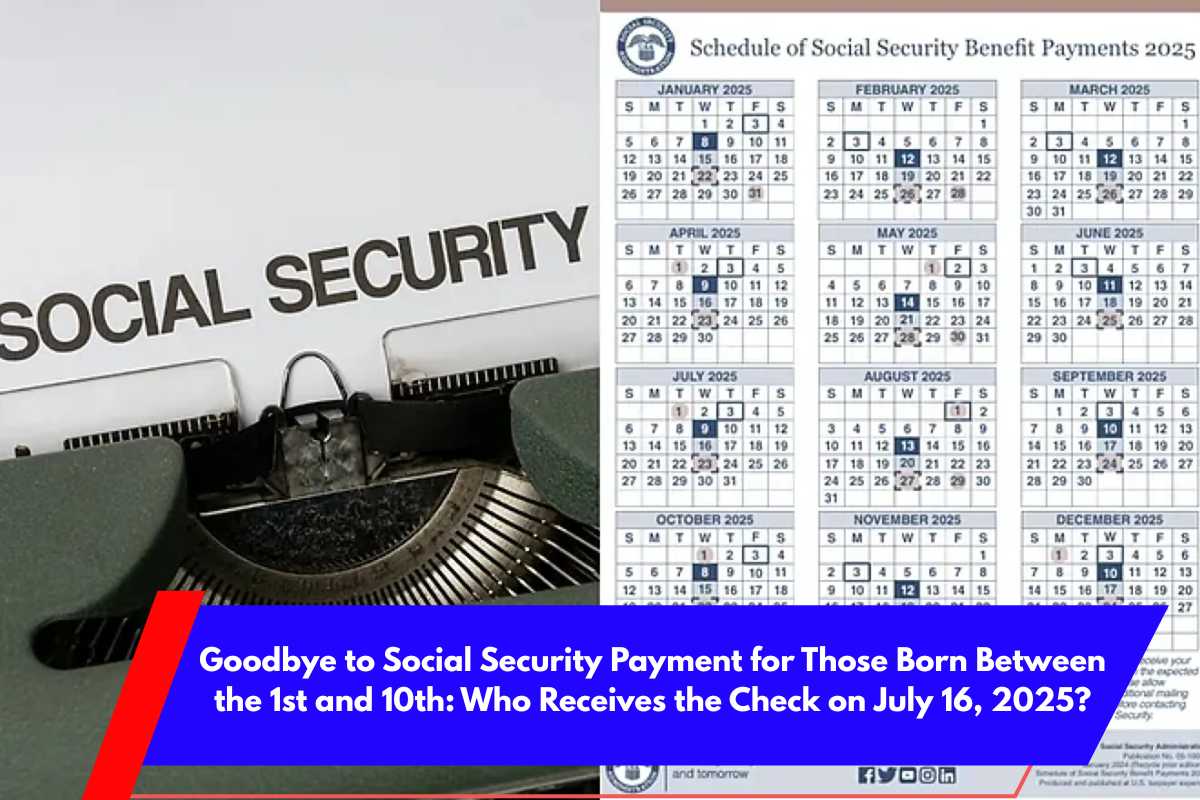

SSDI Payment Dates for July 2025

Here are the SSDI payment dates for July 2025 based on the official SSA schedule:

July 9, 2025: For beneficiaries born between the 1st and 10th of any month.

July 16, 2025: For beneficiaries born between the 11th and 20th of any month.

July 23, 2025: For beneficiaries born between the 21st and 31st of any month.

If you also receive SSI or began claiming benefits before May 1997, your payment schedule may differ. SSI payments arrive on the 1st day of the month, while SSDI for this group arrives on the 3rd day.