Social Security payments, a vital source of income for millions of retirees, are set to go out soon. As of May 2025, the average monthly Social Security check for retired workers reached $2,002.39, marking the first time it has exceeded $2,000.

This increase, while modest at $2.42 from April’s average, reflects the ongoing efforts of the Social Security Administration (SSA) to adjust for inflation and rising costs of living.

With 55.5 million retirees and their families receiving benefits in 2025, the Social Security program continues to serve as a cornerstone of financial support for many Americans.

How Much Does Social Security Provide?

The monthly Social Security benefit varies depending on several factors, including how much you earned, how long you worked, your age when you started collecting benefits, and your marital status. For those who are about to retire or are already receiving benefits, here’s what you can expect in 2025:

Retirement Age: You can start claiming Social Security benefits at age 62, but this will result in reduced payments. The earliest possible retirement benefit for someone retiring at 62 in 2025 will be around $2,831 per month.

Full Retirement Age (FRA): If you choose to retire at your full retirement age (between 66 and 67 based on your birth year), you’ll receive $4,018 per month—this is the standard benefit without any reductions or delayed retirement credits.

Maximum Benefits: If you delay claiming until age 70, you can increase your benefits further. The maximum monthly benefit at age 70 in 2025 is $5,108 due to delayed retirement credits.

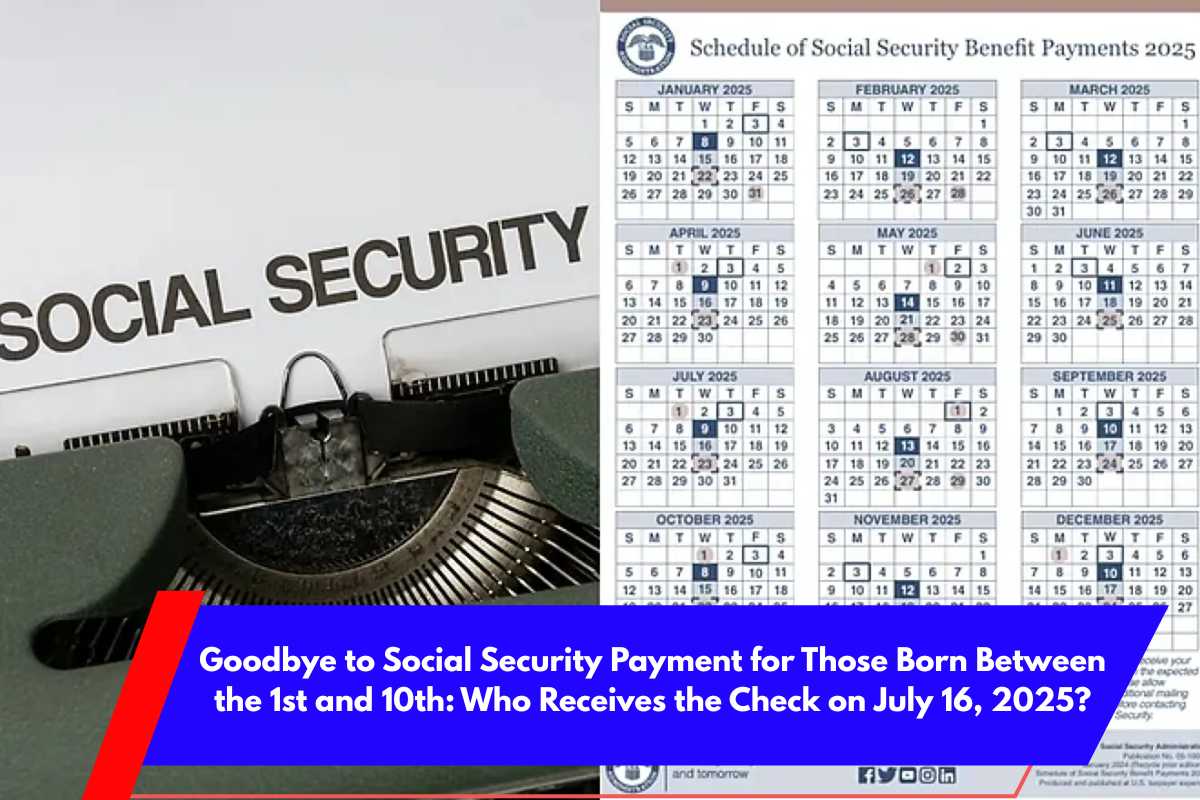

Social Security Payment Dates for July 2025

If you’re waiting for your July Social Security payment, here’s when it will be sent out based on your birth date:

July 9, 2025: For recipients with birthdays between 1st and 10th of the month.

July 16, 2025: For recipients with birthdays between 11th and 20th of the month.

July 23, 2025: For recipients with birthdays between 21st and 31st of the month.

Recipients who started receiving benefits before May 1997 will have already received their payment on July 3, 2025.

How to Maximize Your Social Security Benefits

The key to maximizing your Social Security benefits lies in several strategies:

Work Longer: Social Security benefits are calculated based on your 35 highest-earning years. If you work for less than 35 years, years with zero earnings will be counted, lowering your average. Earning a higher salary during your career will directly impact your monthly benefits.

Delay Your Claim: Delaying the start of your benefits beyond your full retirement age (FRA) allows you to earn delayed retirement credits. This increases your monthly payment, with the highest possible benefit being available at age 70.

Understand the COLA Adjustments: The Cost-of-Living Adjustment (COLA), which adjusts benefits based on inflation, affects the maximum taxable income and Social Security payouts. In 2025, the maximum income subject to Social Security tax is $176,100. This will change in the coming years based on COLA increases.

Requirements for Receiving the Maximum Social Security Benefit in 2026

To receive the maximum benefit of $5,108 in 2025, you must meet specific criteria:

High Earnings: You need to have earned the maximum taxable income for 35 years. If you earn significantly more than the average worker, you are more likely to qualify for the maximum benefit.

Delayed Retirement: You must also delay claiming benefits until age 70 to receive the maximum payout, as delaying your claim accrues delayed retirement credits.