For those receiving Social Security Disability Insurance (SSDI) benefits, it’s important to keep track of the payment schedule set by the Social Security Administration (SSA). These monthly payments are distributed based on the beneficiary’s date of birth.

As we move into July 2025, SSDI payments for the month will be distributed over three Wednesdays: the second, third, and fourth Wednesdays of the month. Here’s everything you need to know about the upcoming payments and the adjustments in SSDI benefits for this year.

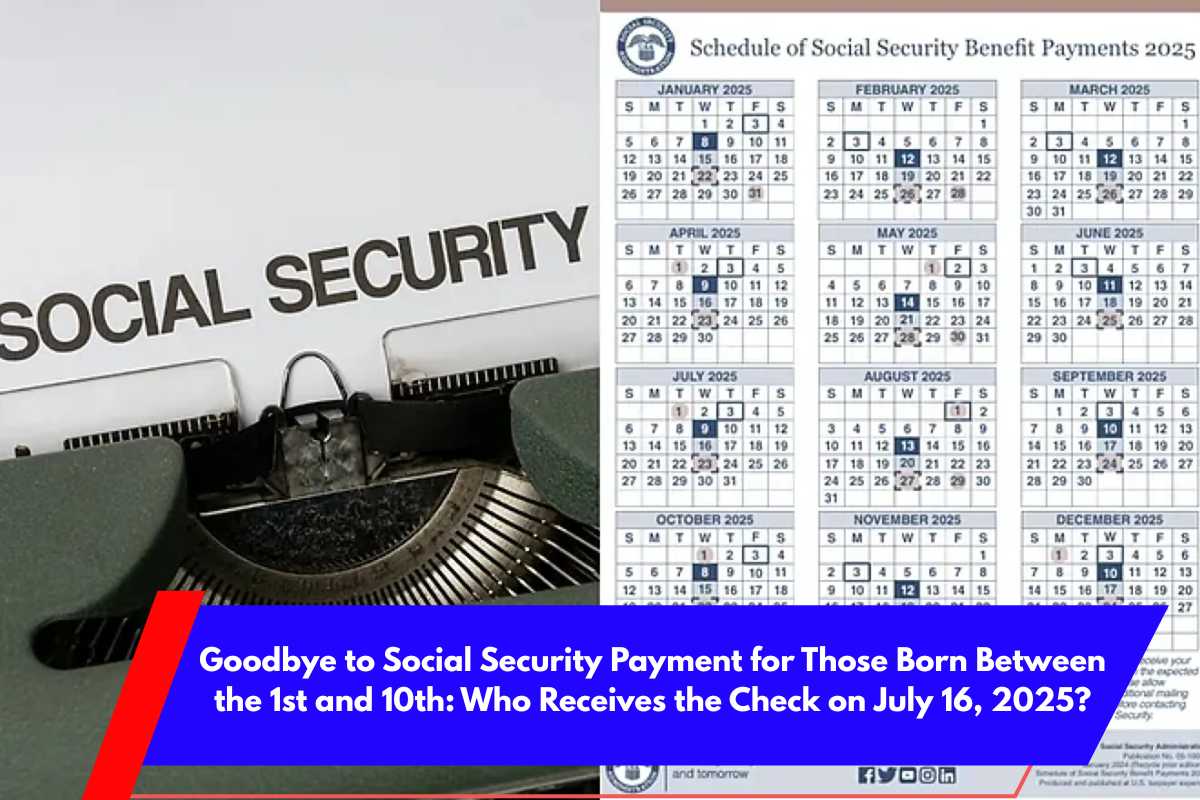

SSDI Payments in July 2025

July 9, 2025 (Second Wednesday): This payment was already processed for those born between the 1st and 10th of the month.

July 16, 2025 (Third Wednesday): This payment is for beneficiaries born between the 11th and 20th of the month. This distribution will be made over two days.

July 23, 2025 (Fourth Wednesday): This payment is for those born between the 21st and 31st of the month, completing the SSDI payment cycle for July.

SSDI Payments for 2025: Maximum and Average Benefits

In 2025, the maximum SSDI benefit a beneficiary can receive is $4,018 per month. This is an increase from previous years, thanks to a 2.5% Cost-of-Living Adjustment (COLA), which helps benefits keep pace with inflation.

The $4,018 Maximum Benefit

The $4,018 amount is the highest possible payment under SSDI and is determined by specific criteria related to an individual’s work history and Social Security contributions throughout their career. However, it’s important to note that not everyone will receive this maximum benefit.

The final SSDI payment amount varies based on your earnings record and the level of contributions you made to the Social Security system over the course of your working life.

Who Qualifies for the Full $4,018 SSDI Payment?

To qualify for the maximum SSDI benefit of $4,018 per month, you need to meet certain eligibility criteria related to the length and amount of your Social Security contributions:

Work History: You must have worked at least 35 full years in jobs that are covered by the Social Security system.

Income Requirements: During those years, your taxable income must have been close to or equal to the annual taxable limit set by the SSA each year.

In 2025, the maximum taxable income for the Social Security program (OASDI), which includes SSDI, is $176,100. This means that only the first $176,100 of your income is subject to the 6.2% tax (employee portion), while any income above that is not taxed.

Example of Contributions

For an employee earning $176,000 in 2025:

The employee’s contribution to Social Security would be 6.2% of $176,100, totaling $10,917.80.

The employer’s contribution would match that, adding another $10,917.80, bringing the total contribution to $21,836.40 for the worker.

For self-employed individuals, they are required to pay the combined 12.4% tax (both employee and employer portions), which would total $21,836.40 if their income meets or exceeds the $176,100 threshold.

What Happens If Your SSDI Payment Is Late?

If your SSDI payment doesn’t arrive on the expected date, the SSA recommends waiting three full business days before taking action. This waiting period allows for any standard processing delays. If the payment is still missing after three days:

Check your bank or Direct Express account to confirm the transaction status.

If the payment is still not showing, you can contact the SSA at 1-800-772-1213 (TTY 1-800-325-0778) or use the My Social Security online portal at ssa.gov/myaccount to report the issue and request a payment trace.